Press Release_______________________

FOR IMMEDIATE RELEASE

March 25, 2025

(Austin, TX) – A new study of teens ages 13-18 conducted by Junior Achievement and MissionSquare Retirement's Foundation reveals that more high school students are being offered financial literacy courses, yet significant knowledge gaps in the curriculum must be filled to help the nation’s youth prepare for their futures.

According to a new survey fielded independently by Wakefield Research, 45% of high schoolers took a personal finance or financial literacy class at school, up from 31% in 2024. Of those students who took their school’s curriculum, 64% found it extremely or very helpful, yet diving deeper, data reveals otherwise.

Topline Data

· 68% of teens agree that saving for retirement is something they can think about later in life.

· 43% of teens believe that an interest rate of 18% on debt is manageable and can be paid off over time.

· 80% of teens have never heard of FICO credit scores or do not fully understand their purpose.

· 42% of teens are terrified they won’t have enough money to cover their future needs and goals.

· Teenagers’ three most appealing investing strategies are savings accounts, side hustles, and keeping cash at home.

· When they receive money, only 36% save a part for their future, 23% save for their education, and 13% invest.

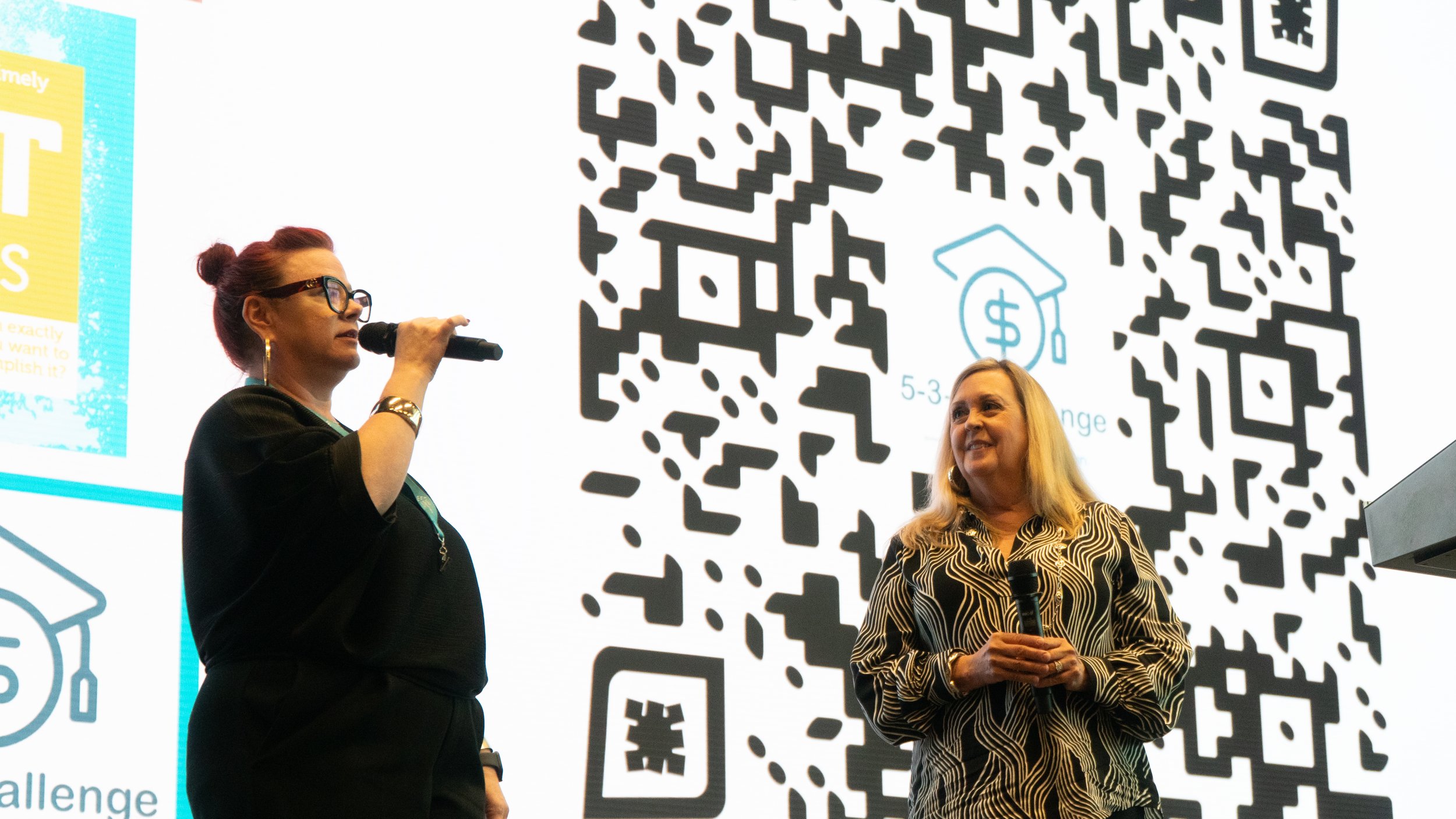

“More states are adopting financial literacy requirements, but this research would indicate that not all of the courses offered are having the desired impact on student knowledge,” said (JA Area Representative). “It’s important that financial literacy courses use evidence-based approaches to positively affect knowledge, attitudes, and behavior, and go beyond simple online courses that may or may not promote those learning outcomes.”

Junior Achievement is a leader in financial literacy programs, with rigorous, multi-year curriculum that aligns with state educational standards that is shown by third-party evaluations to have a positive impact on students’ financial readiness.

Students K-12 have access to nearly 100 Junior Achievement organizations across the country that offer a wide range of programs that use proven programs, engaging curricula, and experienced volunteers to guide students through skills ranging from personal finance, investing, and economics to entrepreneurship, career planning, and creative thinking.

Survey Methodology

The Junior Achievement and MissionSquare Foundation Teens & Personal Finance Survey was conducted by Wakefield Research (www.wakefieldresearch.com) among 1,000 nationally representative US Teens ages 13-18, between February 3rd and 10th, 2025, using an email invitation and an online survey. Data was weighted to ensure a reliable and accurate representation of U.S. teens ages 13-18.

Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results. For the interviews conducted in this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 3.1 percentage points from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample.

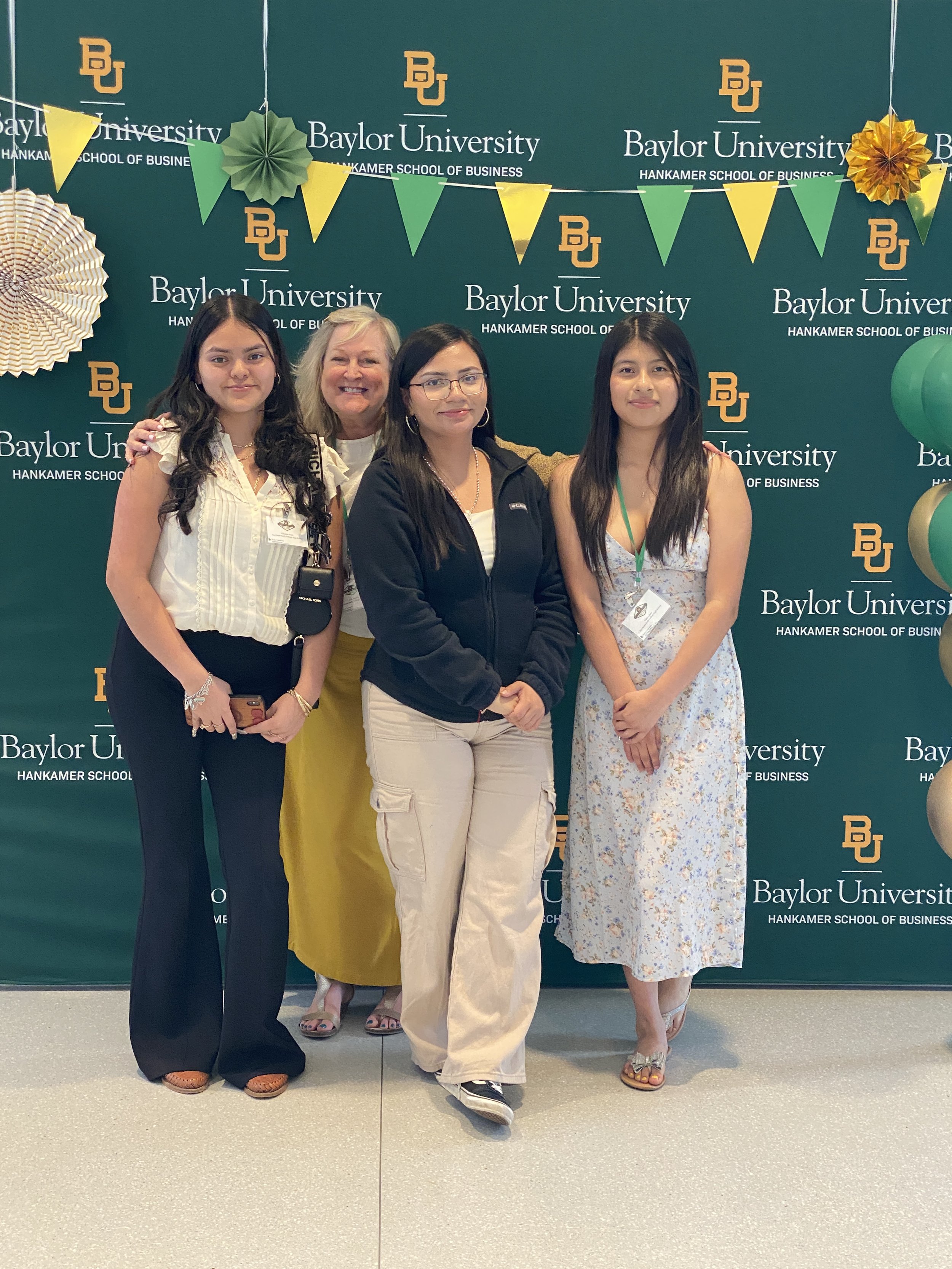

About Junior Achievement of Central Texas

We provide fun, engaging, and hands-on learning experiences in ENTREPRENEURSHIP, FINANCIAL LITERACY, and CAREER READINESS. We and our volunteers, serving as mentors, prepare young people for the real world by demonstrating how to generate wealth and effectively manage it. We show students how money works, how education leads to career opportunities, and how to apply entrepreneurial thinking from their own business endeavors to in the workplace. JA students put these lessons into action and learn the value of contributing to their communities.

About MissionSquare Foundation

The MissionSquare Foundation, launched in 2022 through an initial $20 million grant from MissionSquare Retirement, seeks to make a meaningful impact in our communities by focusing on the long-term well-being of youth. Our core initiatives focus on civic mindedness, financial capabilities, critical thinking and leadership development skills. We believe that cultivating these lifelong skills in our next generation support strong, sustainable and thriving communities. For more information, visit www.missionsq.org.